A common question you might get from the Board is: “Why would this prospect buy now?”

Discovery is the process where you ask questions to uncover critical information about your Ideal Customer Profile and User/Buyer Persona: What pain or challenges do they have today? Is there demand for solving that pain now, and does that pain tie to critical business objectives?

Validation of Your Idea ≠ Discovery

Besides confusing qualification and discovery, first-time founders often fail to distinguish between validation and discovery. They often believe they’re conducting discovery, when in fact, they’re seeking validation of their idea. This usually happens when they ask for feedback from peers within their network. A few examples of validation questions as opposed to discovery questions would be:

Asking questions like those above do not accomplish the critical objectives of discovery, and typically distract founders from getting to real customers. If you find yourself asking validation questions, think about how you can follow up to get down to real discovery questions and get back on track. Example below:

Validation Question: “Would you say that serverless is unpredictable and sometimes slow?”

Prospect Validating: “Yes.”

Discovery Question: “We typically see this when teams first start productionizing serverless use cases. Tell us about what that process was like for you and your team.”

Discovery is arguably the most important part of the deal process and helps confirm whether or not the deal is valid, so it’s critical to treat it as its own separate process from both qualification and validation.

Sales conversations and scenarios will vary with each company and prospect throughout the sales cycle, but we did our best to draw upon our own experience selling to startups and the Fortune 500 through our GAP engagement to come up with this framework to help founders uncover the “art and science” of how to improve the discovery process.

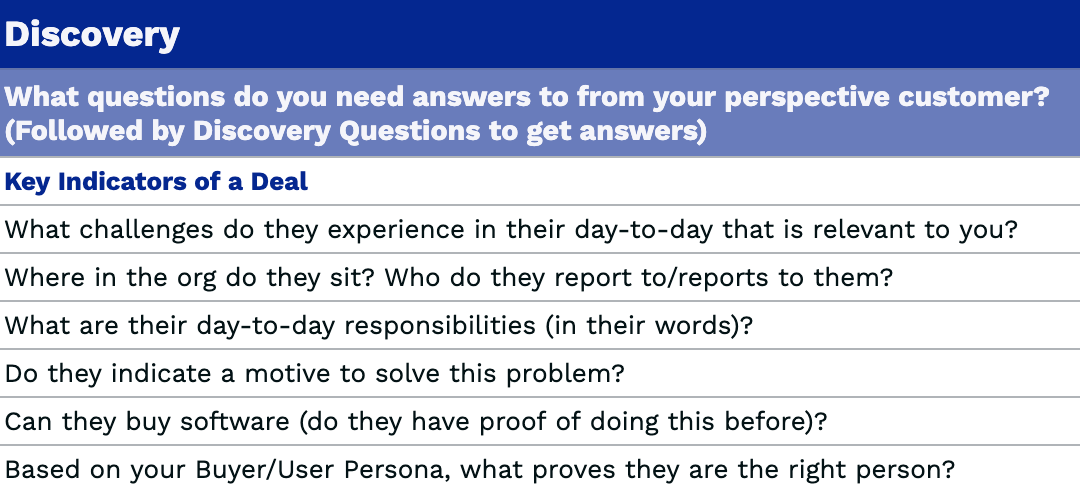

The first step is coming up with your own set of must-have Discovery Questions you absolutely cannot leave the meeting without answering. Ask yourself: “What are the critical questions that must be answered for every deal?”

Pro-tip: Remember that Sales and Discovery meetings are a team sport – get the team involved in coming up with the critical questions!

Below are some examples of common critical discovery questions you might ask on the first call. You’ll notice that several questions center around confirming whether or not this opportunity will become a future deal. It’s important to uncover whether or not the individual you’re speaking to has the authority to buy software and to unearth the specific challenges they’re facing that will make them a customer in the next 3-6 months.

Check out the full set of suggested discovery questions here. (Keep in mind that the tool is offered as a broad framework and should be tailored as needed for your product and team.)

You might not get to every “must-have” question on your list, but you should be keeping track of all the data points you collect that indicate the likelihood of a deal. You can always follow up on the second or third call to collect any additional needed information.

Now that you’ve got your list of “must-have” questions, let’s dive into the discovery call itself.

VP Sales Question: “Why would this buy now from us?”

Every discovery call will be slightly different depending on your team and the individual you’re talking to. But generally speaking, a discovery call looks something like this:

Pro-tip: The entire call should total 30 minutes if you’re covering discovery only, and 60 mins if you’re planning to include a live product demo.

Another common question you will get is: “Why are we betting on this person to get the deal done?”

As previously mentioned, the opportunity should already be properly qualified before you get on the phone. However, it’s still critical to spend the first five minutes of the phone call confirming the information you uncovered. You might find out new information or learn that the information you found was outdated or incorrect. For instance, maybe you read in a LinkedIn job description that GCP was part of their tech stack, when in fact they recently switched to AWS. You also want to make sure that the person you’re betting the deal on can actually make the deal happen or can direct you to the person who can.

If the re-qualification goes smoothly, you’re ready to dive into the meat of the discovery call.

Every discovery call should touch on each of these three dimensions:

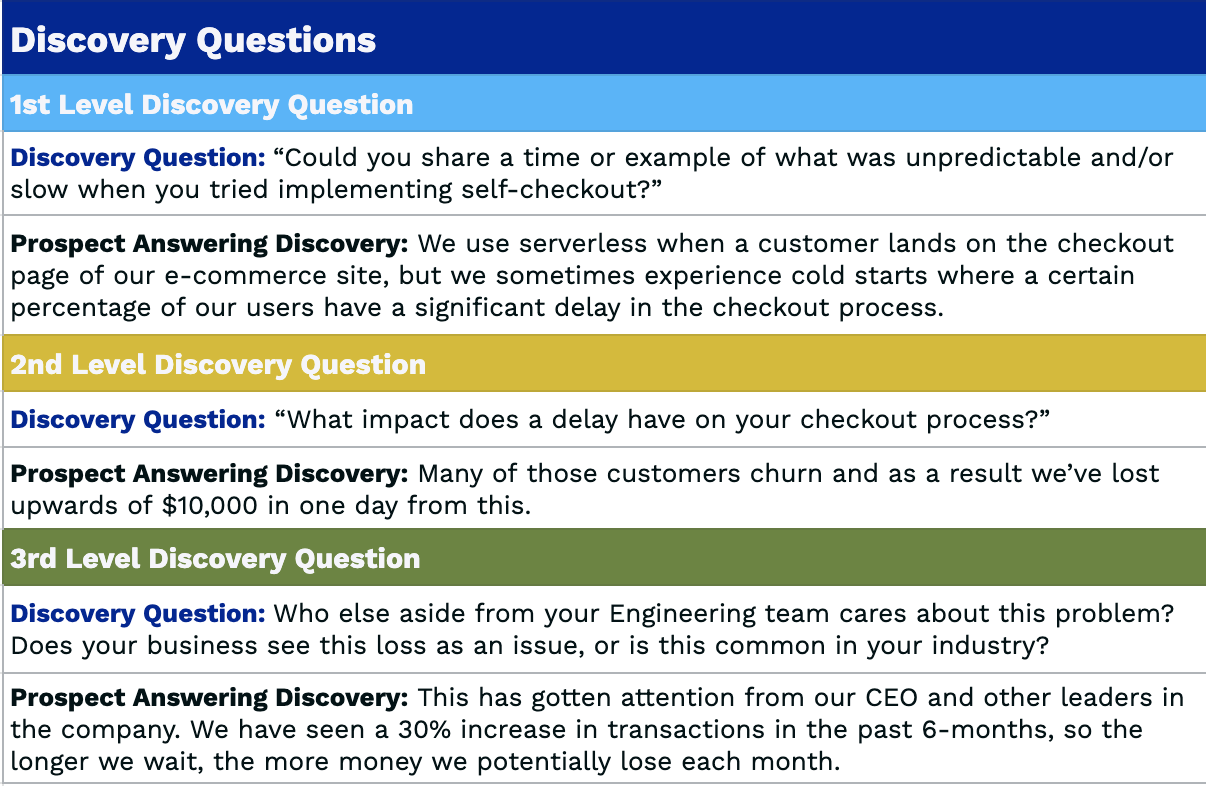

You might’ve heard the saying: “Sell aspirin, not vitamins,” meaning you want to sell something that alleviates real pain, not just a nice-to-have “vitamin” that people can live without. Take it a step further and try to understand why the prospect needs aspirin, and why your product is that proverbial pain reliever. Asking the right questions will help you determine which customer problems you should prioritize and drive you closer to a deal. Look for ways to put a number on the customer’s challenges and desired outcomes. Find ways to go levels deeper on the questions you’re asking to uncover real information. Here’s an example of how one might uncover and quantify the customer’s pain:

Pro tip: Repeat back what you’ve heard from the prospect to show that you are listening and understand them. This reduces the risk of losing a deal down the line due to a misunderstanding. Here are more tips on how to be an active listener on remote calls.

Confirming Prospect Answer: Understood, and thank you for sharing. So if I heard you correctly, the cold-start issue you’re experiencing can potentially lead to $300,000 in losses and even more with your expected growth?

You want to make sure you’re only spending time where the prospect has the need and the ability to buy within the next 3-6 months. (Otherwise, you can return to them later when the challenges are more urgent.)

As a startup selling to your first customers, not only do you need to uncover pain, but also identify a prospect’s willingness to purchase from an unproven startup. As a new entrant, your solution may be creating a new category and require a shift in thinking. Such “paradigm shifts” require a certain individual risk tolerance for them to risk their budget and reputation on a new product like yours.

You have to uncover the customer’s urgent pain and ability to buy immediately, but also be able to tie it all back to a clear business objective. For example, your solution might save the customer significant time and money by automating a workflow, or create a better customer experience and reduce churn. It all comes down to being empathetic and understanding what matters to your customer and their business.

You don’t want to be in a situation where you go through each bucket sequentially, only to run out of time. Instead, a call should naturally weave between all three areas of questions.

If you’re a first-time founder or early in your sales journey, you’ll likely want to use slides in your discovery calls to help guide the conversation. You’ll notice that seasoned salespeople can navigate the first conversation without any or with very few slides, but that can take years to master this approach.

Think through your talk track and the natural inflection points where certain questions from the prospect tend to come up. Come prepared to answer and questions and respond to objections, which can also come up after the call over email. Questions around pricing are especially common, so you should go into any customer conversation with a clear idea of what you’re planning to charge for an engagement. (We’ll dig more into specific pricing strategies in the next section.)

Try to look for signals and keep track of common objections so you can be prepared the next time they come up. The more calls you do, the less you’ll need to rely on slides — aside from a product demo which prospects love to see. The product demo is not just a pitch, but an opportunity to do even deeper discovery.

Great — your opportunity is qualified, you’ve answered your must-have questions on the discovery call, and the prospect meets your criteria as a potential customer. Now what?

Before getting off the phone, you should have determined whether or not your prospect is an ideal user or buyer. If they are a fit, ask for when they are available next and build a mutually agreed upon plan on goals for the next call. If they are not your ideal user/buyer, but they have indicated others in their organization or network would be a better fit, ask if they can introduce you to those people. If possible, schedule your next call while you’re still on the line with them and voiceover what you intend to follow up with over email.

VP Sales: “What are we doing to drive the deal forward?”

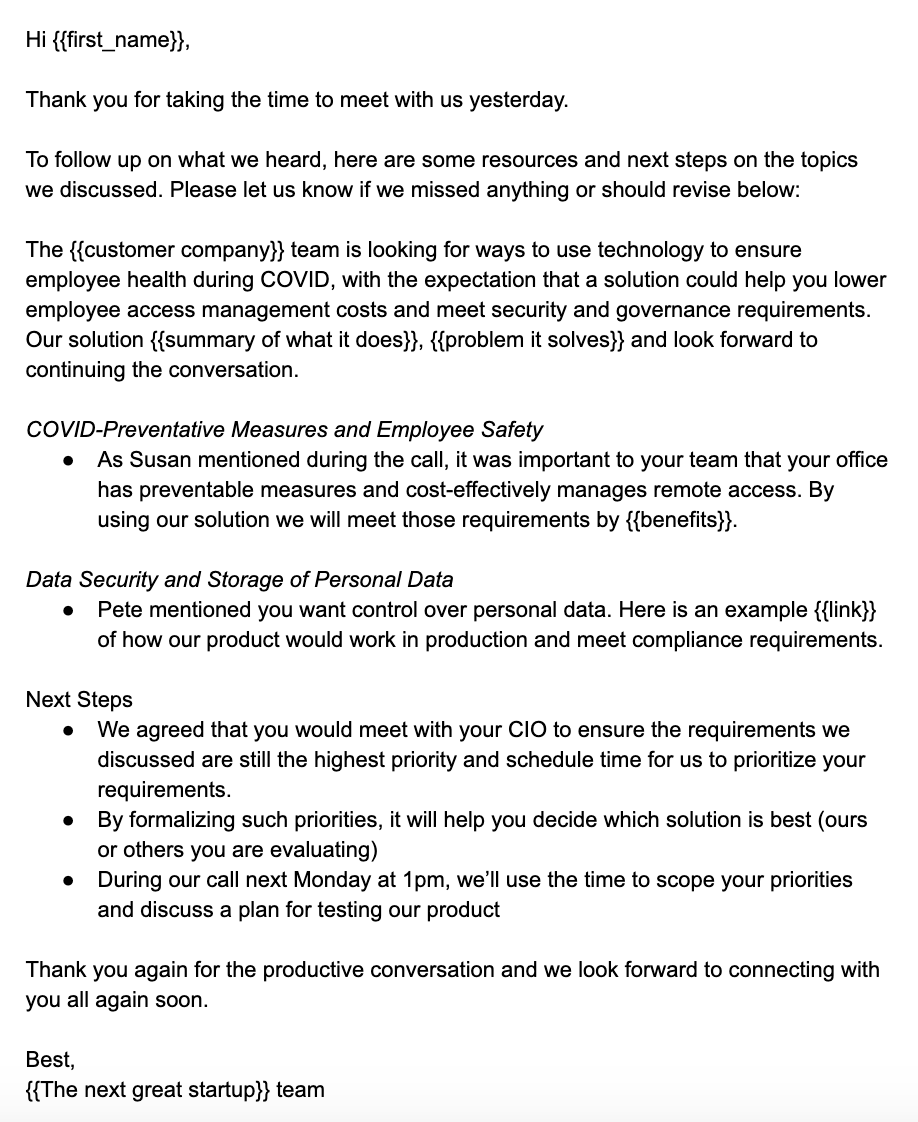

After the discovery call, follow up with what you learned over the call, not more about your features. Many first-time founders make the mistake of flooding the prospect with more information about specific features, without setting the right context about the uncovered problem and solution.

A good follow-up email should:

Here’s an example of a good follow-up email:

VP Sales Question: “How likely is this deal to come in this quarter?”

As we mentioned before, discovery on your second or third call should be different than your first introductory call with a prospect. These later conversations can be used to discover additional pain or challenges and inform your product roadmap or future expansion opportunities. Example below:

As we mentioned in the opening of this section, the discovery process we outlined above is much more flexible than traditional sales processes you might find at a later stage company. Those more formal sales processes might cover concepts including Decision Process, Buying Process, Finding a Champion, etc. Those tactics are critical to master, but tend to become more relevant once you have a repeatable, scalable sales process already in place. When you’re finding those first few design partners, discovery should be a much more nimble activity, focused on uncovering critical customer information to get closer to product market fit.

Properly qualifying deals and conducting thorough discovery during the sales process does this by giving a team more clarity on how to prioritize deals in the pipeline according to the likelihood of closing. Discovery is certainly a critical part of sales, but has many other benefits that impact the broader organization. In an early-stage startup, Product and Engineering teams make decisions on what to prioritize and build based on customer interaction and demand. Factual evidence from discovery conversations can help align your team on customer requirements and the right product roadmap to close more business over time. Quality discovery also improves hand-offs for post-sales teams like Customer Success by giving them more evidence and context on why the customer bought your product, why they bought it from you, and why they decided to buy now.

Assuming you’re hearing the right answers and the prospect is interested in using your solution, you’ll soon be on your way to the next phase of the sales process: Product Testing or the Proof of Concept phase. In the next part, we’ll cover how to identify and validate these processes to ensure you’re only moving forward with Product Testing/Proof of Concept (POC)’s with people who will become future customers.

Continue on to Deal Qualification & Forecasting.